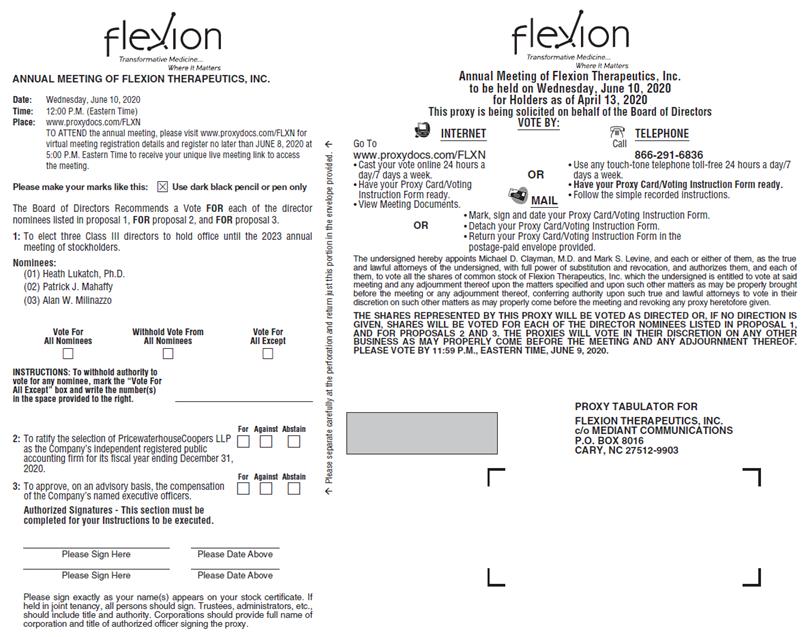

| 1. | To elect the three (3) Class III directors named in the proxy statement to serve on the Company’s Board of Directors until the 20202023 annual meeting of stockholders.stockholders; |

| 2. | To ratify the selection, by the Audit Committee of the Board of Directors, of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2017.2020; |

| 3. | To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the proxy statement; and |

| 3.4. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the proxy statement accompanying this Notice. OurThe Company’s Board of Directors urges you to read the accompanying proxy statement carefully and recommends the approval of each of the proposals, which are more fully described in the proxy statement.

The record date for the annual meeting is April 24, 2017.13, 2020. Only stockholders of record at the close of business on that date may vote at the annual meeting or any adjournment thereof. Important Notice Regarding the Availability of Proxy Materials for the 2017 Annual Meeting2020 annual meeting of Stockholders to Be be

Held on June 22, 201710, 2020. Information for attending the annual meeting is available at the Marriot Hotel, 1 Burlington Mall Road, Burlington, MA 01803.www.proxydocs.com/FLXN. The proxy statement and annual report to stockholders are available free of charge at: www.proxydocs.com/flxn.FLXN. | | | By Order of the Board of Directors

| | /s/ Michael D. Clayman, M.D.

| Michael D. Clayman, M.D.Mark S. Levine | President and Chief Executive OfficerCorporate Secretary |

Burlington, MA April 28, 201729, 2020 You are cordially invited to attend the virtual meeting. Your vote is important. Regardless of whether you plan to attend the virtual meeting, please vote by proxy over the telephone or through the internet as instructed in these materials, or using a proxy card that you may request or that we may elect to deliver at a later time, as promptly as possible, to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote online if you attend the virtual meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder in order to vote your shares that are held in such agent’s name and account. |

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please vote by proxy over the telephone or through the internet as instructed in these materials, or using a proxy card that you may request or that we may elect to deliver at a later time, as promptly as possible, in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder in order to vote your shares that are held in such agent’s name and account.

Table of ContentsContents—2020 Proxy Statement -i-

FLEXION THERAPEUTICS, INC. 10 Mall Road, Suite 301

Burlington, MA 01803

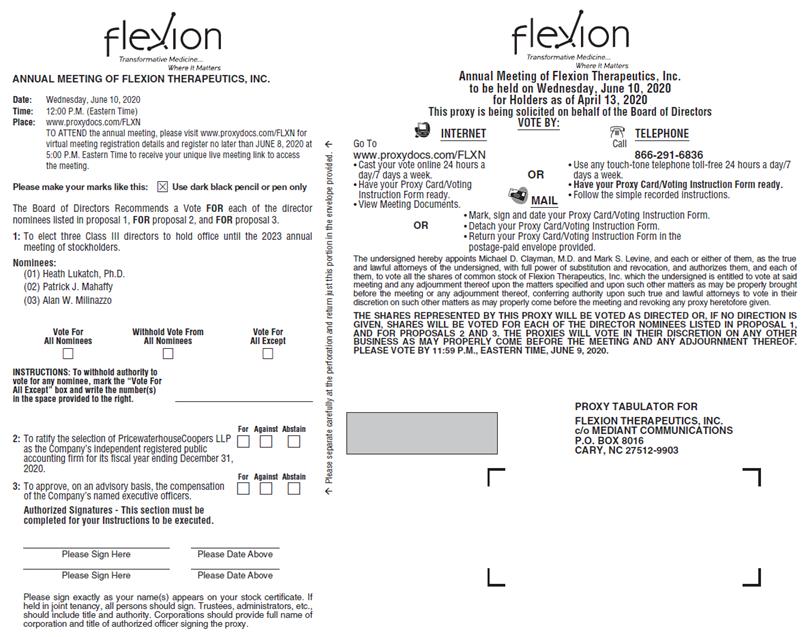

PROXY STATEMENT FOR THE 20172020 ANNUAL MEETING OF STOCKHOLDERS To be held on June 10, 2020 QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTINGQuestions and Answers About These Proxy Materials and Voting

Why did I receive a notice regarding the availability of proxy materials on the internet? Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board of Directors (the “Board of Directors,” “Board” or “our Board”) of Flexion Therapeutics, Inc. (the “Company,” “we,” “our,” “us” or “Flexion”) is soliciting your proxy to vote at the 2017 Annual Meeting2020 annual meeting of Stockholders,stockholders, including at any adjournments or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice. Please note that, while our proxy materials are available at the website referenced in the Notice, and our Notice of Annual Meeting of Stockholders, this proxy statementProxy Statement and 20162019 Annual Report on Form 10-K are available on our website, no other information contained on either website is incorporated by reference in or considered to be a part of this document. Further, information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only. We intend to mail the Notice on or about April 28, 2017May 1, 2020 to all stockholders of record entitled to vote at the annual meeting. Will I receive any other proxy materials by mail? We may send you a proxy card, along with a second Notice,notice, on or after May 8, 2017.12, 2020. How do I attend the annual meeting? The meetingWe will be held on Thursday,hosting the annual meeting only by means of a live webcast. There will not be a physical meeting location and you will not be able to attend the meeting in person. To participate in the annual meeting virtually via the internet, please visit www.proxydoc.com/FLXN prior to the meeting.

You must register by June 22, 20178, 2020 at 1:305:00 p.m. Eastern Time atto attend the Marriot Hotel, 1 Burlington Mall Road, Burlington, MA 01803.annual meeting webcast. DirectionsUpon properly completing your registration, you will receive further instructions via email, including your unique live meeting link that will allow you access to the annual meeting may be found at http://www.marriott.com/hotels/maps/travel/bosbu-boston-marriott-burlington/#directions. Information on howand will permit you to vote in person atsubmit questions before and during the annual meeting is discussed below.and vote.

Who can vote at the annual meeting? Only stockholders of record at the close of business on April 24, 201713, 2020 will be entitled to vote at the annual meeting. On this record date, there were 31,757,69238,562,504 shares of common stock outstanding and entitled to vote. A list of stockholders entitled to vote at the annual meeting will be available for examination at our principal executive offices at the address listed above for a period of 10 days prior to the annual meeting, and during the annual meeting such list will be available for examination at www.proxydoc.com/FLXN.

Stockholder of Record: Shares Registered in Your Name If on April 24, 2017,13, 2020, your shares were registered directly in your name with Flexion’s transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote in personelectronically at the meeting or vote by proxy. Whether or not you plan to attendparticipate in the virtual meeting, we urge you to vote over the internet or by telephone, or by requesting and returning a proxy card, to ensure your vote is counted. Beneficial Owner: Shares Registered in the Name of a Broker or Bank If on April 24, 2017,13, 2020, your shares were held not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the virtual annual meeting. However, since you are not the stockholder of record, you may not vote your shares in personelectronically at the virtual meeting unless you request and obtain a valid proxy from your broker or other agent. What am I voting on? There are twothree matters scheduled for a vote: Election of the three Class III directors named herein to serve on our Board until our 20202023 annual meeting of stockholders; andstockholders (Proposal 1); Ratification of the selection, by the Audit Committee of the Board of Directors, of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2017.2020 (Proposal 2); and An advisory vote on the compensation of the Company’s named executive officers (Proposal 3). What if another matter is properly brought before the meeting? The Board of Directors knows of no other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxyherein to vote on those matters in accordance with their best judgment. How do I vote? YouFor the election of directors, you may either vote “For” all the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For the ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2017,2020, you may vote “For” or “Against” or abstain from voting. For the advisory vote on the compensation of the Company’s named executive officers, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are fairly simple: Stockholder of Record: Shares Registered in Your Name If you are a stockholder of record, you may vote in personelectronically at the virtual annual meeting, vote by proxy over the telephone, vote by proxy through the internet or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attendparticipate in the virtual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the virtual meeting and vote in personelectronically at the meeting even if you have already voted by proxy. To vote at the virtual annual meeting, you must register in person, comeadvance at www.proxydocs.com/FLXN prior to the annualdeadline of June 8, 2020 at 5:00 pm Eastern Time. You will be asked to provide the company number and control number from the Notice. Upon properly completing your registration, you will receive further instructions via email, including your unique live meeting link that will allow you access to the meeting and weyou will give you a ballot when you arrive.have the ability to vote electronically. To vote using the printed proxy card that may be mailed to you, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct.

| • | To vote over the telephone, dial toll-free 1-866-291-6836 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 11:59 p.m., Eastern Time on June 9, 2020 to be counted. |

To vote over the telephone, dial toll-free 1-866-291-6836 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 11:59 p.m., Eastern Time on June 21, 2017 to be counted.

To vote through the internet, go to www.proxypush.com/flxnwww.proxydocs.com/FLXN to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your internet vote must be received by 11:59 p.m., Eastern Time on June 21, 2017 to be counted. Beneficial Owner: Shares Registered in the Name of Broker or Bank If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice containing voting instructions from that organization rather than from Flexion. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote in personelectronically at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or bankother agent included with these proxy materials, or contact your broker, bank or bankother agent to request a proxy form. Internet proxy voting is being provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies. |

Internet proxy voting is being provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

How many votes do I have? On each matter to be voted upon, you have one vote for each share of common stock you own as of April 24, 2017.13, 2020. What happens if I do not vote? Stockholder of Record: Shares Registered in Your Name If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or in person atelectronically during the annual meeting, your shares will not be voted. Beneficial Owner: Shares Registered in the Name of Broker or Bank If you are a beneficial owner and do not instruct your broker, bank or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the particular proposal is considered to be a routine matter under applicable rules. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine” under applicable rules but not with respect to “non-routine” matters. Under applicable rules and interpretations, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation) and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares on ProposalProposals 1 or 3 without your instructions but may vote your shares on Proposal 2 even in the absence of your instruction. What if I return a proxy card or otherwise vote but do not make specific choices? If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of allthree nominees for director named in this proxy statement andstatement; “For” the ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2017.2020; and “For” the approval of the compensation of the Company’s named executive officers. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment. Who is paying for this proxy solicitation? We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice? If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted. Can I change my vote after submitting my proxy? Stockholder of Record: Shares Registered in Your Name Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways: You may submit another properly completed proxy card with a later date (which automatically revokes your earlier proxy). You may grant a subsequent proxy by telephone or through the internet. You may send a timely written notice that you are revoking your proxy to Flexion’s Corporate Secretary at 10 Mall Road, Suite 301, Burlington, MA 01803. You may attend the virtual annual meeting and submit your vote in person.electronically at that time. Simply attending the meeting will not, by itself, revoke your proxy. Your most current proxy card or telephone or internet proxy is the one that is counted. Beneficial Owner: Shares Registered in the Name of Broker or Bank If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank. When are stockholder proposals and director nominations due for next year’s annual meeting? To be considered for inclusion in next year’s proxy materials, your proposal (including a director nomination) must be submitted in writing by December 29, 2017,January 1, 2021, to the attention of the Corporate Secretary of Flexion Therapeutics, Inc. at 10 Mall Road, Suite 301, Burlington, MA 01803. If you wish to submit a proposal (including a director nomination) at the 20182021 annual meeting of stockholders that is not to be included in next year’s proxy materials, you must do so between February 15, 201810, 2021 and March 17, 2018.12, 2021. You are also advised to review Flexion’s amended and restated bylaws (the “Bylaws”), which contain additional requirements about advance notice of stockholder proposals and director nominations. How are votes counted? Votes will be counted by the inspector of election appointed for the meeting, who will separately count, (i) for the proposalProposal 1 to elect directors, votes “For,” “Withhold” and broker non-votes, and, with respect(ii) for Proposal 2 to the ratification ofratify the selection of PricewaterhouseCoopers LLP, votes “For” and “Against,” abstentions and if applicable, broker non-votes.non-votes, and (iii) for Proposal 3, the advisory vote on the compensation of the Company’s named executive officers, votes “For” and “Against” and abstentions. Broker non-votes on Proposals 1 and 3 will have no effect and will not be counted towards the vote total for any of these proposals. What are “broker non-votes”? As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.” Proposals 1 and 3 are considered to be “non-routine” under applicable rules and we therefore expect broker non-votes to exist in connection with those proposals.

How many votes are needed to approve each proposal? For Proposal 1,The following table summarizes the electionminimum vote needed to approve each proposal and the effect of directors, the three nominees receiving the most “For” votes from the holders of shares present in person or represented by proxyabstentions and entitled to vote on the election of directors will be elected. Only votes “For” nominees will affect the outcome.broker non-votes.

To be approved, Proposal 2, ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for our fiscal year ending December 31, 2017, must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

Proposal Number | | Proposal Description | | Vote Required for Approval | | Effect of Abstentions | | Effect of Broker Non-Votes | | | | | | | | | | 1 | | Election of directors | | The three nominees receiving the most “For” votes | | Not Applicable | | None | 2 | | Ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020 | | “For” votes from the holders of a majority of shares present at the virtual meeting or represented by proxy and entitled to vote on the matter | | Against | | Not Applicable | 3 | | Advisory approval of the compensation of the Company’s named executive officers | | “For” votes from the holders of a majority of shares present at the virtual meeting or represented by proxy and entitled to vote on the matter | | Against | | None |

What is the quorum requirement? A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the virtual meeting in person or represented by proxy. On April 13, 2020, the record date, there were 31,757,69238,562,504 shares outstanding and entitled to vote.Thus, the holders ofat least 15,878,84719,281,253 shares must be present in personat the virtual meeting or represented by proxy at the virtual meeting to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in personelectronically at the virtual meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the meeting or the holders of a majority of shares present at the virtual meeting in person or represented by proxy may adjourn the meeting to another date. How can I find out the results of the voting at the annual meeting? Preliminary voting results will be announced at the annual meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the annual meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

FORWARD-LOOKING STATEMENTSForward-Looking Statements

This proxy statement contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, relating to future events. Such statements are only predictions and involve risks and uncertainties, resulting in the possibility that the actual events or performance will differ materially from such predictions. For a nonexclusive list of major factors which could cause the actual results to differ materially from the predicted results in the forward looking statements, please refer to the “Risk Factors” in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 20162019 and in our periodic reports on Form 10-Q and Form 8-K.

PROPOSALProposal 1

ELECTION OF DIRECTORSElection of Directors

The following table sets forth certain information regarding our directors, including their ages as of the date of the annual meeting: | | | | | | | | | CLASS Class

| | NAMEName

| | AGE | | | POSITION HELD WITHTHE COMPANYAge

| | | Position Held With the Company | I | | Michael D. Clayman, M.D. | | | 6568 | | | President, Chief Executive Officer and Director | I | | Sandesh Mahatme, LL.M. | | | 5255 | | | Director | I | | Ann Merrifield | | | 6669 | | | Director | II | | Scott A. Canute | | | 5659 | | | Director | II | | Samuel D. Colella | | | 7780 | | | Director | II | | Mark Stejbach | | | 5357 | | | Director | III | | Heath Lukatch, Ph.D. | | | 5053 | | | Director | III | | Patrick J. Mahaffy | | | 5457 | | | Chairman of the Board of Directorsand Director | III | | Alan W. Milinazzo | | | 5760 | | | Director |

Classified Board The Company’s Board of Directors currently has nine members divided into three classes. Each class consists as nearly as possible, of one-third of the total number of directors and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified. There are three directors in Class III, the class whose term of office expires in 2017.2020. Each of the nominees listed below areis currently serving as a director of the Company and was previously elected by our stockholders. If elected at the annual meeting, each of these nominees would serve until the 20202023 annual meeting of stockholders and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. It is the Company’s policy to encourage its directors and nominees for director to attend the annual meeting. All of our directorsDr. Clayman, Mr. Colella, Dr. Lukatch, Mr. Mahaffy, Mr. Mahatme, Ms. Merrifield, Mr. Milinazzo and Mr. Stejbach attended the Company’s 20162019 annual meeting of stockholders. Directors are elected by a plurality of the votes of the holders of shares present in personat the virtual meeting or represented by proxy and entitled to vote on the election of directors. Accordingly, the three nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead will be voted for the election of a substitute nominee proposed by the Company. Each person nominated for election has agreed to serve if elected. The Company’s management has no reason to believe that any nominee will be unable to serve. The following is a brief biography of each nominee for director and each director whose term will continue after the annual meeting.meeting: CLASSClass III DIRECTOR NOMINEESFOR ELECTIONFORA THREE-YEAR TERM EXPIRINGATTHE 2020 ANNUAL MEETINGDirector Nominees for the Election for Three-Year Term Expiring at the 2023 Annual Meeting

Heath Lukatch, Ph.D. has served as one of our directors since 2012. Dr. Lukatch is the Founder and Managing Partner of Red Tree Venture Capital. He currently serves as the Chairman of the board of directors at Inogen, Inc. and Satsuma Pharmaceuticals, Inc., both publicly traded companies, and as Chairman of Engage Therapeutics, Inc. a private biopharmaceutical company. He also currently serves as a board member at Adynxx, Inc., Halo Neuroscience Inc., SutroVax Inc., Ceribell Inc., ViaCyte, Inc. and ViewPoint Therapeutics, Inc. Previously, Dr. Lukatch was a Partner and Managing Director at TPG Biotech, a life science venture investment firm. From 2006 untilCapital from 2015 through March 2020. Prior to joining TPG in 2015, Dr. Lukatch was a Partner at Novo Ventures (US) Inc., which provides certain consultancy services toVentures. During his nine years at Novo, A/S, a Danish limited liability company that manages investments and financial assets. Dr. Lukatch joined Novo Ventures (US) Inc. in 2006. He currently servesserved as Chairman of theCianna Medical, Inc. (acquired by Merit Medical Systems Inc. in 2018), Inogen, NTP, Inc. and Spinifex Pharmaceuticals, Inc. (acquired by Novartis International AG in 2015), as a board of directors of Inogen, Inc., a publicly traded medical technology company. Previously he was a member of the board of directors of a number of private companies, including Amira Pharmaceuticals Inc. (acquired by Bristol-Myers Squibb Company in 2011), AnaptysBio, Inc., Cianna Medical, Inc., Elevation Pharmaceuticals Inc. (acquired by Sunovion Pharmaceuticals, Inc. in 2012), FoldRx Pharmaceuticals, Inc. (acquired by Pfizer, Inc. in 2010), InSound Medical, Inc. (acquired by Sonova USA Inc. in 2010), Spinifex,Nora Therapeutics Inc. and Synosia Therapeutics AG (acquired by BioTie Therapies Corp. in 2011) and he was also a board observer at Alios BioPharma Inc. (acquired by Johnson & Johnson Inc. in 2014), Dynavax Technologies Corp., Fluidigm Corporation and SI-Bone, Inc. Prior to joining Novo, Ventures (US) Inc., Dr. Lukatch was a Managing Director responsible for biotechnology venture investments at Piper Jaffray Ventures and SightLine Partners, a private equity firm and spin off of Piper Jaffray Ventures, from 2001 to 2006. Prior to joiningPartners. Before Piper Jaffray Ventures, Dr. Lukatch worked as a strategy consultant with McKinsey & Company, where he was a consulting firm.leader in McKinsey’s biotechnology practice. Dr. Lukatch also served as co-founder and Chief Executive OfficerCEO of AutoMate

Scientific, Inc., a biotechnology instrumentation company, and he has held scientific positions with Chiron Corporation, a biotechnology company, Inc., Roche Bioscience a healthcare company,Plc and Cetus Corporation, a biotechnology company.doing molecular biology, electrophysiology and protein chemistry, respectively. Dr. Lukatch received his Ph.D. in Neuroscience from Stanford University where he was a DOD USAFDepartment of Defense U.S. Air Force Fellow, and his B.A. with high honors in Biochemistry from the University of California at Berkeley. Our Board believes that his extensive industry experience, his experience with venture capital investments, and his experience of serving on the board of directors for several biopharmaceutical and healthcare companies qualifies Dr. Lukatch to serve on our Board of Directors.

Patrick J. Mahaffy has served as one of our directors and as Chairman of our Board since 2009. Mr. Mahaffy has served as the President, Chief Executive Officer, and a director of Clovis Oncology, Inc., a biopharmaceutical company, since 2009, and also serves2009. He served on the board of directors of Orexigen Therapeutics Inc., a publicly traded biopharmaceutical company.from 2009 until 2018. Previously, Mr. Mahaffy served as President and Chief Executive Officer and as a member of the board of directors at Pharmion Corporation, a pharmaceutical company that he founded in 2000 and sold to Celgene Corporation in 2008. From 1992 through 1998, Mr. Mahaffy was President and Chief Executive Officer of NeXagen, Inc. and its successor, NeXstar Pharmaceuticals, Inc., a biopharmaceutical company. Prior to that, Mr. Mahaffy was a Vice President at the private equity firm E.M. Warburg Pincus and Co. He is also a trustee of Lewis and Clark College. Mr. Mahaffy earned a B.A. in international affairs from Lewis and Clark College and ana M.A. in international affairs from Columbia University. Our Board believes that Mr. Mahaffy’s experience and expertise in the pharmaceutical industry qualifies him to serve on our Board of Directors. Alan W. Milinazzo has served as one of our directors since 2011. Mr. Milinazzo is a partner in the Global Healthcare and Life Sciences Practice at Heidrick & Struggles International, Inc., a global executive search and leadership consulting firm, a position he has held since January 2016. Prior to then, fromFrom 2013 to 2016, he served as President, Chief Executive Officer and a member of the board of directors of InspireMD, Inc., a publicly traded medical device company. From 2006 to 2011, Mr. Milinazzo served as president and chief executive officer of Orthofix International, N.V., a publicly traded global orthopedic company, a position he was promoted to in 2006 after initially being hired as the company’s chief operating officer in 2005. From 2002 to 2005, Mr. Milinazzo served as the General Manager of Medtronic, Inc.’s coronary and peripheral vascular businesses. He currently servesIn 2019, Mr. Milinazzo was appointed executive chairman of the board of directors of Opsens Inc. Mr. Milinazzo also formerly served on the board of directors of CAS Medical Systems, Inc. (CASMED), a publicly traded medical technology company. Mr. Milinazzo formerly served on the boards offrom 2013, until its acquisition by Edwards Life Sciences Corporation in 2019, LDR Holding Corporation, a publicly traded medical device company, from 2015 until its acquisition by Zimmer Biomet Holdings in June 2016, and on the board of directors of Orthofix International, N.V. from December 2006 until June 2012. HeMr. Milinazzo received his undergraduate degree from Boston College. Our Board of Directors believes that Mr. Milinazzo’s expertise in management and marketing in the pharmaceutical and medical device market and his 25 years of experience in the healthcare and life sciences sector qualifies him to serve on our Board of Directors. THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH NAMED NOMINEE.The Board of Directors Recommends

a Vote “FOR” Each Named Nominee for Proposal 1

CLASSClass I DIRECTORS CONTINUINGIN OFFICE UNTILTHE 2018 ANNUAL MEETINGDirectors Continuing in Office Until the 2021 Annual Meeting

Michael D. Clayman, M.D. was is a co-founder and has served as our President, Chief Executive Officer and as one of our directors since our inception in 2007. Dr. Clayman also serves as the Chairman of the board of directors of both Anokion SA and Ribometrix Inc., both private biopharmaceutical companies. From 2014 to 2018, Dr. Clayman served on the board of directors of Akebia Therapeutics, Inc. and Anokion SA, each, a publicly traded biopharmaceutical company. Previously, Dr. Clayman had a lengthy career at Eli Lilly and Company, a global pharmaceutical company, where he was most recently Vice President, Lilly Research Laboratories, and General Manager of Chorus, Lilly’s early-phase development accelerator. During his career at Lilly, Dr. Clayman also led its Global Regulatory Affairs division, the Cardiovascular Discovery Research and Clinical Investigation, Research and Development at Advanced Cardiovascular Systems, a medical device subsidiary of Lilly, the Internal Medicine Division, the Lilly Clinic, Lilly’s dedicated Phase 1 unit, and served as Chair of Lilly’s Bioethics Committee. Prior to his tenure at Lilly, Dr. Clayman was an Assistant Professor in theSchool of Medicine at the University of Pennsylvania, where his research centered on the immunopathogenesis of renal disease. Dr. Clayman is the recipient of the Physician Scientist Award from the National Institutes of Health. Dr. Clayman earned a B.A., cum laude, from Yale University and an M.D. from the University of California, San Diego School of Medicine. Following an internship and residency in Internal Medicine at the University of California, San Francisco Moffitt Hospitals, Dr. Clayman completed clinical and research fellowships in Nephrology at the University of Pennsylvania. Our Board believes that Dr. Clayman’s clinical and research experience, along with his more than 20 years of experience in pharmaceutical development, qualifies him to serve on our Board of Directors. Sandesh Mahatme, LL.M. has served as one of our directors since 2014. Since November 2012, Mr. Mahatme has served as Senioris the Executive Vice President, Chief Financial Officer and Chief FinancialBusiness Officer at Sarepta Therapeutics, Inc., a publicly traded biopharmaceutical company. Mr. Mahatme joined Sarepta in 2012. From January 2006 to November 2012, Mr. Mahatme worked at Celgene Corporation, a publicly traded biopharmaceutical company, where he served in various roles, including Senior Vice President of Corporate Development, Senior Vice President of Finance, Corporate Treasurer and Head of Tax. While at Celgene, Mr. Mahatme built the treasury and tax functions before establishing the Corporate Development Department, focused on strategic, targeted initiatives including commercial development in emerging markets, acquisitions, licensing and global manufacturing expansion. From 1997 to 2005 Mr. Mahatme worked for Pfizer Inc., a pharmaceutical company, where he served in senior roles in business development and corporate tax. Mr. Mahatme started his career at Ernst & Young LLP where he advised multinational corporations on a broad range of transactions. Mr. Mahatme also serves

on the board of directors of Aeglea Biotherapeutics,BioTherapeutics, Inc., a publicly traded biotechnologypublic company, focused on treatments for cancer and certain genetic diseases.Elcelyx Therapeutics, Inc., a private biopharmaceutical company. Mr. Mahatme earned LL.M. degrees from Cornell Law School and NYU School of Law and is a member of the New York State Bar Association. Our Board believes that Mr. Mahatme’s financial expertise qualifies him to serve on our Board of Directors. Ann Merrifield has served as one of our directors since 2014. From December 2012 to July 2014, Ms. Merrifield served as President and Chief Executive Officer of PathoGenetix, Inc., a privately held health technologygenomics company, which voluntarily filed for Chapter 7 bankruptcy in July 2014. Prior to joining PathoGenetix, Inc., Ms. Merrifield served an 18-year tenure at Genzyme Corporation (now owned by Sanofi S.A.), a diversified, global biotechnology company. At Genzyme, Ms. Merrifield served most recentlyin a number of leadership roles, including as President of Genzyme Biosurgery, where she led global business strategy across a portfolio of biologics, therapeutic devices and combination products, and was previously Vice President of Marketing, General Manager andas President of Genzyme Genetics, where she played an instrumental role in developing and shaping itsthis diagnostic business. Prior to joining Genzyme, Ms. Merrifield was a Partner at Bain and Company, a global strategy consulting firm, and an Investment Officer at Aetna Life & Casualty. She currently serves as a directorthe Chair of the board of directors of InVivo Therapeutics Holdings Corp. and Juniper Pharmaceuticals, Inc., bothCorporation, a publicly traded biotechnology companies,company, and a member of the board of directors of Lyra Therapeutics, Inc., a private company, since 2019. Ms. Merrifield also serves as a trustee of MassMutual Premier, Select and MML Series Investment Funds. Previously, Ms. Merrifield served as a director of Juniper Pharmaceuticals, Inc., a publicly traded biotechnology company which was acquired by Catalent, Inc. in 2018. Ms. Merrifield earned a B.A. in Zoology and a Master of Education from The University of Maine, and an M.B.A. from the Amos Tuck School of Business at Dartmouth College. Our Board believes that Ms. Merrifield’s commercial expertise specifically in the intra-articular injection field qualifies her to serve on our Board of Directors. CLASSClass II DIRECTORS CONTINUINGIN OFFICE UNTILTHE 2019 ANNUAL MEETINGDirectors Continuing in Office Until the 2022 Annual Meeting

Scott A. Canute has served as one of our directors since 2015. Mr. Canute served as President of Global Manufacturing and Corporate Operations at Genzyme Corporation from 2010 to 2011. Prior to joining Genzyme, Mr. Canute spent 25 years at Eli Lilly and Company and served as President, Global Manufacturing Operations from 2004 to 2007. Mr. Canute currently serves as Executive Director of Immunomedics, Inc. a publicly trade biopharmaceutical company. Previously, Mr. Canute served as a member of the board of directors of ProteonArTara Therapeutics, a biopharmaceutical company focused on renalInc. and vascular disease. Mr. Canute also serves on the board of directors of Oncobiologics,Akebia Therapeutics, Inc., a both publicly traded biopharmaceutical company focused on developing, manufacturing and commercializing biosimilars, and on the board of directors of Akebia Therapeutics, Inc., a publicly traded biopharmaceutical company focused on renal disease.companies. Also, Mr. Canute previously served as a member of the board of directors of AlloCure, Inc., Inspiration Biopharmaceuticals, Inc., Outlook Therapeutics, Inc. (previously Oncobiologics, Inc.), the National Association of Manufacturers and the Indiana Manufacturers Association. Mr. Canute earned a B.S. in chemical engineering from the University of Michigan and an M.B.A. from Harvard Business School. Our Board believes that Mr. Canute’s manufacturing and operational experience in the biopharmaceutical industry and his experience of serving on the board of directors for several biopharmaceuticals companies qualifies Mr. Canute to serve on our Board of Directors. Samuel D. Colella has served as one of our directors since 2008. Mr. Colella is a Managing Director of Versant Ventures, a healthcare venture capital firm he co-founded in 1999, and has been a general partner of Institutional Venture Partners since 1984. Mr. Colella currently serves as Chairman of the board of directors of Fluidigm Corporation, a publicly traded biotechnology tools company, and is a member of the board of directors of several private companies. Mr. Colella previously served on the board of directors of Genomic Health, Inc., a molecular diagnostics company, from 2001 to 2014, Alexza Pharmaceuticals, Inc., a pharmaceutical company, from 2002 to 2012, Jazz Pharmaceuticals, Inc., a biopharmaceutical company, from 2003 to 2012 and Veracyte, Inc., a molecular diagnostics company, from 2006 to 2014. Mr. Colella earned a B.S. in business and engineering from the University of Pittsburgh and an M.B.A. from Stanford University. Our Board believes that Mr. Colella’s broad understanding of the life science industry and his extensive experience in working with emerging private and public companies qualifies him to serve on our Board of Directors. Mark P. Stejbach joined our board of directors in 2016. Mr. Stejbach currently serves as Senior Commercial Advisor at EIP Pharma, Inc. Previously, Mr. Stejbach served as Senior Vice President and Chief Commercial Officer at Alkermes plc, a publicly traded global biopharmaceutical company. Mr. Stejbach has over 30 years of experience in the biotech and pharmaceuticals,pharmaceutical industries, including senior roles in a broad range of commercial functions including marketing, sales, economic affairs, managed care and finance. Prior to his current role at Alkermes, Mr. Stejbach served as the Chief Commercial Officer at Tengion, Inc. from 2008 to 2012, and he previously held senior positions at Merck & Co. and Biogen. MarkBiogen Inc. Mr. Stejbach received his M.B.A. from the Wharton School, University of Pennsylvania and a B.S. in mathematics from Virginia Tech. Our Board believes that Mr. Stejbach’s executive and operational experience in the pharmaceutical industry and commercial expertise qualifies him to serve on our Board of Directors.

Information Regarding the Board of Directors and Corporate Governance INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

INDEPENDENCEOF THE BOARDOF DIRECTORSIndependence of the Board of Directors

As required under the NASDAQNasdaq Stock Market (“NASDAQ”Nasdaq”) listing standards, a majority of the members of a listed company’s board of directorsour Board must qualify as “independent,” as affirmatively determined by the board of directors.Board. The Board consults with the Company’s legal counsel to ensure that the Board’s independence determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in the pertinent Nasdaq listing standards, of NASDAQ, as in effect from time to time. Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and the Company, itsour senior management and itsour independent auditors, the Board has affirmatively determined that, with the exception of Dr. Clayman, all of ourthe directors are independent directors within the meaning of the applicable NASDAQNasdaq listing standards. In making this determination, the Board found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company. BOARD LEADERSHIP STRUCTUREBoard Leadership Structure – POSITIONOF BOARD CHAIRIS SEPARATEFROMTHE POSITIONOFPosition of Board Chair is Separate From the Position Of CEO

The Board has an independent chair, Mr. Mahaffy, who has authority, among other things, to call and preside over Board meetings, including meetings of the independent directors, to set meeting agendas and to determine materials to be distributed to the Board. Accordingly, the Board Chair has substantial ability to shape the work of the Board. The Company believes that separation of the positions of Board Chair and Chief Executive Officer reinforces the independence of the Board in its oversight of the business and affairs of the Company. In addition, the Company believes that having an independent Board Chair creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in the best interests of the Company and its stockholders. As a result, the Company believes that having an independent Board Chair can enhance the effectiveness of the Board as a whole. ROLEOFTHE BOARDIN RISK OVERSIGHTRole of the Board in Risk Oversight

One of the board’sBoard’s key functions is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, ourthe Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company. OurThe audit committee has the responsibility to consider and discuss ourthe major financial risk exposures and the steps ourthe Company’s management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also monitors compliance with legal and regulatory requirements. OurThe nominating and corporate governance committee monitors the effectiveness of ourthe Company’s corporate governance practices, including whether they are successful in preventing illegal or improper liability-creating conduct. OurThe Company’s compensation committee assesses and monitors whether any of ourthe compensation policies and programs has the potential to encourage excessive risk-taking. Further, the Board is actively monitoring the risks associated with the ongoing public health impact of the novel coronavirus pandemic that causes the COVID-19 disease, particularly as it relates to potential disruptions that could severely impact the Company’s commercialization of ZILRETTA®, on-going and future clinical trials and supply chain. MEETINGSOF THE BOARDOF DIRECTORSMeetings of the Board of Directors

The Board of Directors met sevenfive times during the last fiscal year. EachAll Board membermembers, except Scott Canute, attended at least 75% or more of the aggregate number of meetings of the Board, and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member. Scott Canute was unable to attend two meetings of the Board and two meetings of the Nominating and Corporate Governance Committee because of a family emergency in each case.

INFORMATION REGARDING COMMITTEESOFTHE BOARDOF DIRECTORSInformation Regarding Committees of the Board of Directors

The Board has three standing committees: anAn Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for fiscal 20162019 for each of the Board committees: | Name | | Audit | | Compensation | | Nominating and

Corporate

Governance | | Audit | | Compensation | | Nominating and Corporate Governance | Scott A. Canute | | | | | | X | | | | | | X | Samuel D. Colella | | | | X | | X* | | | | X | | X* | Heath Lukatch, Ph.D. | | | | X | | | | | | X | | | Patrick J. Mahaffy | | | | X* | | X | | | | X | | X | Sandesh Mahatme, LL.M. | | X* | | | | | | X* | | | | | Ann Merrifield | | X | | | | | | X | | | | | Alan W. Milinazzo | | X | | | | | | | | X* | | | Total meetings in fiscal 2016 | | 5 | | 5 | | 2 | | Mark Stejbach | | | X | | | | | Total meetings in fiscal year 2019 | | | 4 | | 4 | | 4 |

In March 2017, Mr. Milinazzo ceased serving on the Audit Committee and joined the Compensation Committee. Mark Stejbach joined the Board on September 13, 2016 and joined the Audit Committee in March 2017.

Below is a description of each standing committee of the Board. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board has determined that each member of each committee meets the applicable NASDAQNasdaq rules and regulations regarding “independence” and each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

Audit CommitteeCommittee The Audit Committee of the Board (the “Audit(“Audit Committee”) was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to oversee the Company’s corporate accounting and financial reporting processes and audits of its financial statements. For this purpose, the Audit Committee performs several functions, including, among other things: Evaluating the performance, independence and qualifications of our independent auditors and determining whether to retain our existing independent auditors or engage new independent auditors; Reviewing and approving the engagement of our independent auditors to perform audit services and any permissible non-audit services; Monitoring the rotation of partners of our independent auditors on our engagement team as required by law; Prior to engagement of any independent auditor, and at least annually thereafter, reviewing relationships that may reasonably be thought to bear on their independence, and assessing and otherwise taking the appropriate action to oversee the independence of our independent auditors; Reviewing our annual and quarterly financial statements and reports, including the disclosures contained under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and discussing the statements and reports with our independent auditors and management; Reviewing with our independent auditors and management significant issues that arise regarding accounting principles and financial statement presentation and matters concerning the scope, adequacy and effectiveness of our financial and information technology controls; Reviewing with management and our auditors any earnings announcements and other public announcements regarding material developments; Establishing procedures for the receipt, retention and treatment of complaints received by us regarding financial controls, accounting or auditing matters and other matters; Preparing the Audit Committee report that the SEC requires in this proxy statement; Reviewing and providing oversight of any related-person transactions in accordance with our related person transaction policy and reviewing and monitoring compliance with legal and regulatory responsibilities, including our Code of Business Conduct and Ethics; Reviewing our major financial risk exposures, including the guidelines and policies to govern the process by which risk assessment and risk management is implemented; Reviewing on a periodic basis our investment policy; and Reviewing and assessing its performance on an annuala periodic basis. The Audit Committee is currently composed of three directors: Mr. Mahatme, Ms. Merrifield and Mr. Stejbach. The Audit Committee met fivefour times during the fiscal year 2016.2019. The Board has adopted a written Audit Committee charter that is available to stockholders on the Company’s website at www.flexiontherapeutics.com. The Board reviews the NASDAQNasdaq listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of theour Audit Committee are independent (as independence is currently defined in Rule 5605(c)(2)(A)(i) and (ii) of the NASDAQNasdaq listing standards). The Board has also determined that Mr. Mahatme qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made a qualitative assessment of Mr. Mahatme’s level of knowledge and experience based on a number of factors, including his formal education and experience as a chief financial officer for public reporting companies.

Report of the Audit Committee of the Board of DirectorsCommittee The material in this report is not “soliciting material,” is not deemed “filed” with the CommissionSEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. The Audit Committee has reviewed and discussed the Company’s audited financial statements for the fiscal year ended December 31, 20162019 with management of the Company. The Audit Committee has discussed with the Company’s independent registered public accounting firm the matters required to be discussed by Auditing Standard No. 1301,Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (“PCAOB”). The Audit Committee has also received the written disclosures and the letter from the Company’s independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the audit committeeAudit Committee concerning independence and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016.2019. Mr. Sandesh Mahatme, LL.M. Ms. Ann Merrifield Mr. Alan W. Milinazzo(1)Mark Stejbach (1) | Mr. Milinazzo ceased serving on the Audit Committee in March 2017. |

Compensation Committee The Compensation Committee of the Board (the “Compensation(“Compensation Committee”) is currently composed of four directors: Mr. Colella, Dr. Lukatch, Mr. Mahaffy and Mr. Milinazzo. All members of the Company’s Compensation Committee are independent (as independence is currently defined in Rule 5605(d)(2) of the NASDAQNasdaq listing standards). The Compensation Committee met fivefour times during fiscal year 2016.2019. The Board has adopted a written Compensation Committee charter that is available to stockholders on the Company’s website at www.flexiontherapeutics.com. The functions of the Compensation Committee include, among other things: Reviewing, modifying and approving (or if it deems appropriate, making recommendations to the full Board regarding) our overall compensation strategy and policies; Reviewing and approving the compensation and other terms of employment of our executive officers; Reviewing and approving performance goals and objectives relevant to the compensation of our executive officers and assessing their performance against these goals and objectives; Reviewing and approving (or if it deems it appropriate, making recommendations to the full Board regarding) the equity incentive plans, compensation plans and similar programs advisable for us, as well as modifying, amending or terminating existing plans and programs; Evaluating risks associated with our compensation policies and practices and assessing whether risks arising from our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on us; Reviewing and approving (or if it deems it appropriate, making recommendations to the full Board regarding) the type and amount of compensation to be paid or awarded to our non-employee board members; Establishing policies with respect to votes by our stockholders to approve executive compensation as required by Section 14A of the Exchange Act and determining our recommendations regarding the frequency of advisory votes on executive compensation; Reviewing and assessing the independence of compensation consultants, legal counsel and other advisors to the Committee as required by Section 10C of the Exchange Act; Administering our equity incentive plans; Establishing policies with respect to equity compensation arrangements; Reviewing the competitiveness of our executive compensation programs and evaluating the effectiveness of our compensation policy and strategy in achieving expected benefits to us; Reviewing and approving the terms of any employment agreements, severance arrangements, change inof control protections and any other compensatory arrangements for our executive officers; Reviewing the adequacy of its charter on a periodic basis; ReviewingTo the extent applicable, reviewing with management and approving any disclosures under the caption “Compensation Discussion and Analysis” in our periodic reports or proxy statements filed with the SEC;

PreparingTo the extent applicable, preparing a report regarding any disclosures required under the caption “Compensation Discussion and Analysis”; and

Reviewing and assessing its performance on an annuala periodic basis. Compensation Committee Processes and Procedures Typically, theThe Compensation Committee meets quarterlyperiodically throughout the year and with greater frequency if necessary. The Compensation Committeealso meets regularly in executive session. From time to time, various members of management and other employees, as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Company’s Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation or his individual performance. The charter of the Compensation

Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company, as well as authority to obtain, at the expense of the Company, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties.

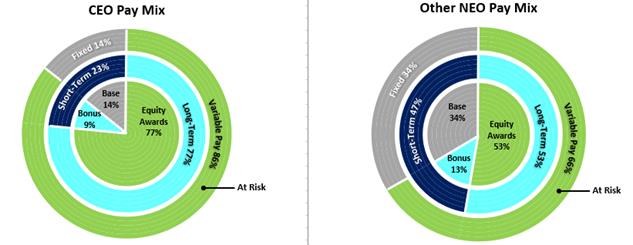

Historically, the Compensation Committee has met at one or more meetings held during the first quarter of the year or during the fourth quarter of the previous year to discuss and, if appropriate, make recommendations to the Board regarding, annual compensation adjustments, annual bonuses, annual equity awards and new performance objectives. For executives other than the Company’s Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to it by the Chief Executive Officer. In the case of the Company’s Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee in consultation with external advisors that may be engaged from time to time. For all executives, as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, executive stock ownership information, company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels, compensation surveys and recommendations of any compensation consultant, as applicable. Generally, the Compensation Committee has designed the Company’s overall executive compensation program to achieve the following objectives: Attempt to attract and retain talented and experienced executives; Motivate and reward executives whose knowledge, skills and performance are critical to our success; Provide a competitive compensation package that aligns the interests of our executive officers and stockholders by including a significant variable component which is weighted heavily toward performance-based rewards; Ensure fairness among executive officers by recognizing the contributions each executive makes to our success; and Foster a shared commitment among executives by aligning their individual goals with our corporate goals and the creation of stockholder value. The Compensation Committee retained an independent compensation consultant, Radford, an Aon Hewitt company (“Radford”), to assist the Compensation Committee in developing the Company’s overall executive and director compensation programs for 2016 and 2017,2019, including base pay, bonus percentage and equity awards. To assist in determining executive compensation in 2016,2019, Radford and the Compensation Committee reviewed a peer group of publicly traded companies in the life sciences industry at a stage of development, market capitalization and size comparable to ours.the Company. The Compensation Committee believed these companies were generally comparable to ourthe Company and that wethe Company competed with these companies for executive talent. In addition to the publicly available information with respect to peer group companies, Radford gathered competitive market data from the Radford Global TechnologyLife Sciences Survey of public biopharmaceutical companies with less than 100 employees for the Compensation Committee’s analysis of executive compensation. THESPECIFICDETERMINATIONSOFTHE COMPENSATION COMMITTEEWITHRESPECTTOEXECUTIVECOMPENSATIONFORFISCAL 2016AREDESCRIBEDINGREATERDETAILUNDERTHEHEADING “EXECUTIVE COMPENSATION.The specific determinations of the Compensation Committee with respect to executive compensation for fiscal year 2019 are described in greater detail under the heading “Executive Compensation.”

COMPENSATION COMMITTEE INTERLOCKSAND INSIDER PARTICIPATIONCompensation Committee Interlocks and Insider Participation

As noted above, the Company’s Compensation Committee consists of Mr. Colella, Dr. Lukatch, Mr. Mahaffy and Mr. Milinazzo. No member of the Compensation Committee has ever been an executive officer or employee of the Company. None of the Company’s executive officers currently serves, or has served during the last completed year, on the compensation committee or board of directors of any other entity that has one or more executive officers serving as a member of the Board or the Compensation Committee. Nominating and Corporate Governance Committee The Nominating and Corporate Governance Committee of the Board (the “Nominating(“Nominating and Corporate Governance Committee”) is currently composed of three directors: Mr. Canute, Mr. Colella and Mr. Mahaffy. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the NASDAQNasdaq listing standards). The Nominating and Corporate Governance Committee met twofour times during fiscal year 2016.2019. The Board has adopted a written Nominating and Corporate Governance Committee charter that is available to stockholders on the Company’s website at www.flexiontherapeutics.com.

The functions of ourthe Nominating and Corporate Governance Committee include, among other things: Identifying, reviewing and evaluating candidates to serve on the Board consistent with criteria approved by the Board;our Board of Directors; Determining the minimum qualifications for service on the Board; Evaluating director performance on the Board and applicable committees of the Board and determining whether continued service on the Board is appropriate; Evaluating, nominating and recommending individuals for membership on the Board; Evaluating nominations by stockholders of candidates for election to the Board; Considering and assessing the independence of members of the Board; Developing a set of corporate governance policies and principles, including a Code of Business Conduct and Ethics, periodically reviewing and assessing these policies and principles and their application and recommending to the Board any changes to such policies and principles; Considering questions of possible conflicts of interest of directors as such questions arise; Reviewing the adequacy of its charter on an annual basis; and Reviewing and assessing its performance on an annuala periodic basis. The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee typically considers diversity, age, skills and such other factors as it deems appropriate, given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. The Nominating and Corporate Governance Committee also takes into account the results of the Board’s self-evaluation, conducted periodically on a group and individual basis. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote. The Company has adopted a formal policy for receiving and considering director candidates recommended by stockholders. Pursuant to the policy, the Nominating and Corporate Governance Committee will not alter the manner in which it evaluates candidates based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: 10 Mall Road, Suite 301, Burlington, MA 01803, Attn: Corporate Secretary, no later than the 90th day and no earlier than the 120th day prior to the one year anniversary of the preceding year’s annual meeting of stockholders. Submissions must include (1) the name and address of the Company stockholder on whose behalf the submission is made; (2) the number of Company shares that are owned beneficially by such stockholder as of the date of the submission; (3) the full name of the proposed candidate; (4) a description of the proposed candidate’s business experience for at least the previous five years; (5) complete biographical information for the proposed candidate; (6) a description of the proposed candidate’s qualifications as a director and (7) any other information required by our Bylaws. Each submission must also be accompanied by the written consent of the proposed candidate to be named as a nominee and to serve as a director if elected. The Company may require any proposed nominee to furnish such other information as the Company may reasonably require to determine the eligibility of such proposed nominee to serve as an independent director of the Company or that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, of such proposed nominee. The Nominating and Corporate Governance Committee also has the authority to engage third-party search firms to identify and provide information on potential candidates. During 2016,

Stockholder Communications with the Nominating and Corporate Governance Committee engaged Russell Reynolds Associates, an independent executive and director search firm, to assist it in identifying and recruiting suitable director candidates, including Mr. Stejbach, to our Board. Russell Reynolds Associates was paid $100,000 in fees in fiscal year 2016 for their services. STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORSBoard of Directors

The Company has adopted a formal process by which stockholders may communicate with the Board or any of ourits directors. Pursuant to this policy, stockholders wishing to communicate with the Board or an individual director may send a written communication to the Board or such director c/o Flexion Therapeutics, Inc., 10 Mall Road, Suite 301, Burlington, MA 01803, Attn: Corporate Secretary. Written communications may be submitted anonymously or confidentially and may, at the discretion of the person submitting the communication, indicate whether the person is a stockholder or other interested party. Alternatively, stockholders may submit communications to the Board as a group through the Investor page of our website at http:https://ir.flexiontherapeutics.com.ir.flexiontherapeutics.com/corporate-governance/contact-the-board. Each communication will be reviewed by the Company’s Corporate Secretary to determine whether it is appropriate for presentation to the Board or the applicable director. Communications determined by the Secretary to be appropriate for presentation to the Board or the applicable director will be submitted to the Board or such director on a periodic basis. Communications determined by the Corporate Secretary to be inappropriate for presentation will still be made available to any non-management director upon the director’s request. CODEOF ETHICSCode of Ethics

The Company has adopted the Flexion Therapeutics, Inc. Code of Business Conduct and Ethics that applies to all officers, directors and employees. The Code of Business Conduct and Ethics is available on the Company’s website at www.flexiontherapeutics.com.https://ir.flexiontherapeutics.com. If the Company makes any substantive amendments to the Code of Business Conduct and Ethics or grants any waiver from a provision of the Code to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website.

PROPOSALProposal 2

RATIFICATIONOF SELECTIONOF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMRatification Of Selection Of Independent Registered Public Accounting Firm

The Audit Committee has selected PricewaterhouseCoopers LLP (“PwC”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 20172020 and has further directed that management submit the selection of its independent registered public accounting firm for ratification by the stockholders at the annual meeting. PwC has audited the Company’s financial statements since 2007.2010. Representatives of PwC are expected to be present at the annual meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions. Neither the Company’s Bylaws nor other governing documents or law require stockholder ratification of the selection of PwC as the Company’s independent registered public accounting firm. However, the Audit Committee is submitting the selection of PwC to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain PwC. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of different independent auditors at any time during the year if they determineit determines that such a change would be in the best interestsinterest of the Company and its stockholders. The affirmative vote of the holders of a majority of the shares present in personat the virtual meeting or represented by proxy and entitled to vote on the matter at the annual meeting will be required to ratify the selection of PwC. PRINCIPAL ACCOUNTANT FEESAND SERVICESPrincipal Accountant Fees and Services

The following table represents aggregate fees billed to the Company for the fiscal years ended December 31, 20162019 and December 31, 2015,2018, by PwC, the Company’s principal accountant.accountant: | | | | | | | | Fiscal Year Ended | | | | 2016 | | 2015 | Audit Fees(1) | | $ 548,750 | | $ 435,000 | Audit-related Fees | | — | | — | Tax Fees(2) | | 61,702 | | 85,250 | All Other Fees(3) | | 1,800 | | 1,800 | | | | | | Total Fees | | $ 612,252 | | $ 522,050 |

| | Fiscal Year Ended | | Types of Fees | | 2019 | | | 2018 | | Audit Fees (1) | | $ | 919,550 | | | $ | 783,075 | | Audit-Related Fees | | | — | | | | — | | Tax Fees (2) | | | 30,907 | | | | 2,103 | | All Other Fees (3) | | | 2,756 | | | | 2,756 | | Total Fees | | $ | 953,213 | | | $ | 787,934 | |

(1) | “Audit Fees” consist of fees for the audit of the Company’s financial statements and the review of the interim financial statements included in the Company’s quarterly reports on Form 10-Q and audit services provided in connection with other statutory or regulatory filings. |

(2) | “Tax Fees” consist of fees for professional services primarily related to tax compliance, tax advice and tax planning. |

(3) | “All Other Fees” represent fees associated with access to an onlineon-line accounting research database.database and disclosure checklist. |

In connection with the audit of the Company’s 20162019 financial statements, the Company entered into an engagement agreement with PwC that setsset forth the terms by which PwC will performperformed audit services for the Company. PRE-APPROVAL POLICIESAND PROCEDURESPre-Approval Policies and Procedures

The Audit Committee has not adopted a policy and procedures for the pre-approval of audit and non-audit services rendered by ourthe Company’s independent registered public accounting firm and consequently all audit and non-audit services are pre-approved by the whole Audit Committee or the Audit Committee Chair. THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 2.

The Board of Directors Recommends

a Vote “For” Proposal 2

EXECUTIVE OFFICERSProposal 3